Investment Criteria

Sandwater supports entrepreneurs who are building fantastic companies that will help solve global challenges. We are inspired by the wealth of ideas and the tremendous enthusiasm that we see every day when meeting with these teams. To prioritize the opportunities, we have established a set of criteria for a successfully collaboration between Sandwater and you. Here’s what we are looking for:

Key requirements that we will always consider in our first meeting:

A great team and set-up: The people in the company are of course most essential, but we also assess the overall structure and potential for scaling, and the ecosystem that supports the company

Doing good: We seek to invest in companies that make a positive impact – propelling forward those companies which will lead the way globally in driving positive climate impact and improvements to our health systems.

Potential for outstanding financial returns We are looking for companies that can scale really well, and can turn the investment into great financial returns for our investors

Sandwater can make a contribution: We want to contribute with more than just capital, and believe in close collaboration to get there

Overall requirements:

Company maturity: We look for companies that are close to or have commercial traction with solutions and are ready to scale up. We rarely would make the early seed funding in a company, and we do not invest in companies at the IPO stage or later.

Ticket size: The average size of our first-time investment is about 25MNOK (2,5MEUR). We rarely make a first-time investment below 10MNOK (1MEUR) or above 40MNOK (4MEUR).

Investment capacity: We like supporting our successful initial investments with follow-on investments and we can invest a total of up to 100MNOK (10MEUR) in each company. Furthermore, together with our fund LPs and extensive co-investment ecosystem, we can often facilitate investments significantly beyond our own capacity.

Geographical scope: We focus our efforts on European companies where we have strong networks and operational experience.

Thematic focus:

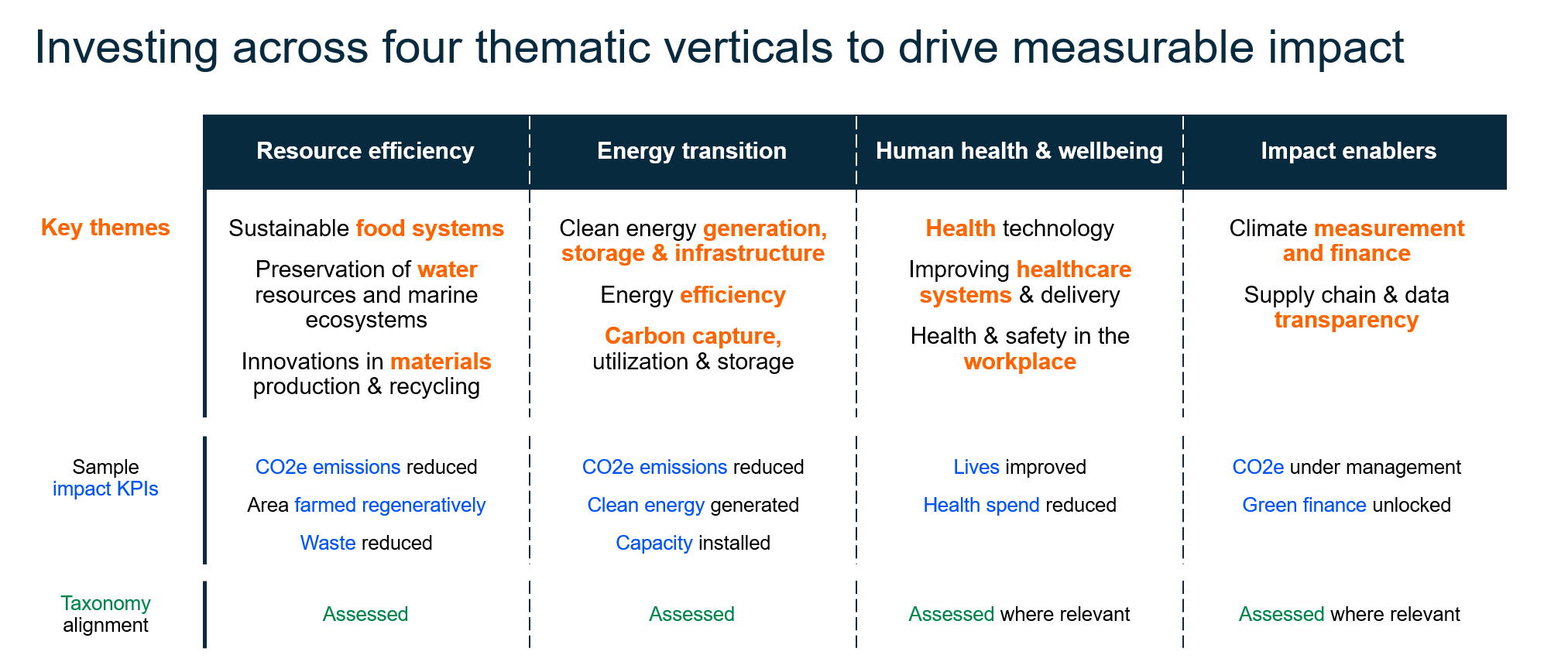

We are thematic investors focusing on four verticals in which we seek to make an outsized positive impact. Each of our investments is associated with specific impact KPI(s), that follow from the theory of change underlying the investment. As active owners, we track these KPIs and work proactively with our portfolio companies to maximize their impact throughout our ownership period. For those investments primarily targeting environmental impact, we also assess alignment with the EU Taxonomy.

Sandwater Investment Themes

Exclusions

As a Category 8 fund under the EU regulation we also need to maintain an exclusion list ie investments we categorically cannot make. Such exclusions are based either on the particular industries the companies operate under or on their mode of operations. For impact-oriented companies these exclusions are fortunately rarely a constraining factor, but we nevertheless find it beneficial to list our exclusion criteria here.

Think we could be great partners together in changing the world for the better? Tell us a little about you and your company!

Subscribe

Stay in the loop - sign up for our newsletter